Improving the social component of the Environmental, Social, and Governance (ESG) framework has a significant impact on business performance, especially when it comes to staff retention – yet many businesses fail to recognise the immense potential lying dormant in their workplace. The ‘S’ in ESG is often misunderstood or underemphasised. In layman’s terms, the ‘Social’ in ESG is all about how a company interacts with people – employees, suppliers, customers, and the community in which it operates. Enhancing the ‘S’ creates opportunities to enhance business performance.

To help you reduce the adverse effects of staff turnover and enhance retention, we’ll explain the connection between the ‘S’ in ESG and intervention strategies for staff turnover.

The Importance of Improving Your Social Component

ESG is a framework proven to be crucial for financial performance. A report from the University of Oxford demonstrated that over 80% of businesses adopting robust ESG practices witnessed improvements in operational performance, stock performance, and a reduced cost of capital. The potential for such gains makes the social aspect of ESG—assessing a company’s relationships with employees, customers, and the community—all the more critical.

Key elements of the ‘S’ component include workplace culture, health, safety, and employee retention. By focusing on these aspects, organisations can better understand their employees, their fit within the company, their treatment, and how to maximise their potential. The ‘S’ is the secret sauce that helps you understand your employees to create a strong workplace culture, ensure their health and safety, and keep your top talent on board.

Performance indicators like employee engagement scores, gender diversity, and capital funding towards social initiatives are often tracked to gauge performance. Yet 2023 stats show that 38% of Australian workers plan to leave their job within the next 12 months – a clear indicator that there is an underlying problem in the ‘S’ component of ESG.

“Where organisations are looking to transform and put sustainability at their core, in addition to structural changes, employee upskilling and sustainability programs, they’ll also need to prioritise organisational culture and behaviours.”

PwC report

How Is Staff Turnover Affecting Your Business?

Staff turnover costs businesses. According to the 2022 Retention Report by Work Institute, replacing an employee incurs a cost equivalent to 33% of their base pay. Let’s put this into cold hard numbers. An organisation of 1,000 employees with an average wage of $60,000 and a turnover rate of 38% will incur a turnover cost of $7,321,080 per year. And these wage and turnover rates are conservative estimates.

Sound hard to believe? Your company’s turnover costs can be estimated using a staff turnover calculator created by the State Government of Victoria. (Brace yourself first).

Yet the impact of staff turnover goes beyond the dollars. The intangible effects—lost knowledge, increased workloads, declining morale, and HR burden—are equally detrimental. The quality of products or services can suffer with a less experienced workforce. Turnover triggers a vicious cycle of rehiring that is incredibly costly to any business.

Given that almost a third of Australian businesses struggle to find suitable staff, it is easy to see how the problem of turnover quickly compounds into a significant financial situation.

“It’s obviously much better, more efficient, more cost-effective to keep the people we’ve already got than to go out and bring in new team members.”

Vanessa Porter, Managing Director, All of You

Where to Start with Intervention Strategies for Staff Turnover?

Identifying where to start when it comes to staff retention interventions depends on your organisation’s unique needs and priorities and what is going to give you the best return.

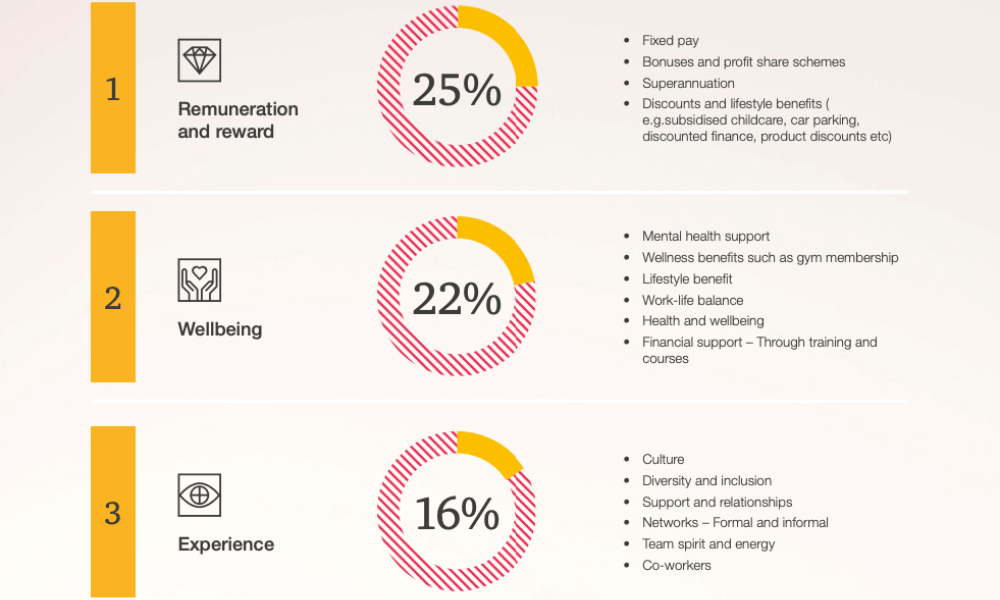

A report by PwC found that pay, well-being, and experience were the top three things employees want from their employers. Vanessa Porter, in a recent seminar, noted that she observes different patterns, with lost time injury prevalent in hospitals and manufacturing sectors. The bottom line is leaders need awareness of what is happening specific to their organisation.

The difficulty is that when you become aware of the reasons for turnover, it is often too late to act. Vanessa Porter highlights the problem with the current HR processes and insights. “The problem with lag indicators is that the challenge already exists, and you are reacting. I think there’s a huge opportunity here to be proactive. If you can automatically pull various lead indicators together, and then make meaning from those with insights, that will make a substantial difference.”

To be proactive, you need to harness the power of data to identify the intervention that aligns with your overall business strategy. HR and Payroll systems brim with valuable data that offer insights into your team’s performance and attrition.

The answer to the data problem lies in an automated reporting system, where you don’t need to sort through masses of information or copy and paste data from one location to the next. You can quickly identify problems and nip them in the bud before they escalate.

“This is why I like RetainTalent. It allows targeted interventions and real-time monitoring, enabling organisations to pinpoint where improvements are needed. The best part is that you can see the changes within a day, a week, or a month, making it easier to tweak and adapt strategies accordingly.”

Vanessa Porter, Managing Director, All of You

Quick Recap

The social aspect of ESG directly impacts staff retention and financial performance, yet most companies underutilise the potential that sits within their workforce. By understanding and addressing the ‘S’ in ESG, businesses can boost staff retention, enhance business performance, and break the costly cycle of constant rehiring. But with so much data to sort through, it can be difficult to identify where to start.

The solution is to bring all these insights together in an automated, easy-to-understand, single report. Using your data and machine learning, predictive models can be developed to anticipate staff turnover so you can develop targeted early interventive strategies. With the correct data and insights at your fingertips, you can be proactive, not reactive. So why wait? It’s time to harness your data’s true potential for a stronger, more sustainable business.

- The ‘S’ pillar of ESG is critical to business performance, especially staff retention.

- Staff turnover has significant costs beyond rehiring and becomes a vicious cycle.

- It is more efficient, cost-effective and sustainable to retain staff.

- Pay, well-being, and experience were reported to be the top three priorities for employees, but it is important to examine the unique needs of your organisation.

- Automated reporting that presents you with actionable insights makes proactive intervention easy.